Today, automotive megatrends are driving the rise in semiconductor composition. Key drivers include: power system key applications such as improving vehicle energy efficiency and using clean energy technologies for automotive, smart electric vehicle power management, and the use of energy-efficient gearboxes; key automotive applications such as networking, advanced lighting, and LED lighting; Safety/chassis key applications such as collision avoidance, dynamic braking; key applications for infotainment systems such as driver information, plug-in equipment/charging; emerging markets, including re-use of proven architectures in mature markets to meet automotive pricing requirements, although Cheap cars have lower semiconductor components, but they are used in large quantities.

This article refers to the address: http://

For the luxury car market, the problem is to seize different needs, improve power performance, and achieve maximum emissions reduction; electric vehicles are still niche markets, using power electronics different from traditional internal combustion engines, the challenge is to take traditional and proven Technology is integrated into electric vehicles. Therefore, cheap cars are in batches, luxury cars are innovating, and electric cars are a new technology. These are all conducive to the development of the automotive semiconductor market.

China's automotive semiconductor market has great potential

China has become the world's largest automotive market and continues to lead the global automotive market. By 2017, China's annual production of automobiles is expected to reach 30 million units (28% of the total output of 107.1 million vehicles worldwide); from 2012 to 2017, China's automobile production compound annual growth rate (CAGR) is 11%. After experiencing rapid growth in economic and automotive industry stimulus measures from 2009 to 2010, and after the slowdown in liquidity tightening, from 2014 to 2015, although some big cities are limiting car growth, they are relaxing monetary policy, some Under the premise of fiscal stimulus and price no longer falling, the growth trend of China's light vehicle sales is shifting from “soft†landing to “controllable†growth. After 2017, we will focus on the steady growth of demand management measures for fuel.

The automotive market is directly related to the automotive semiconductor market, but it has its own particularities. The growth rate of the European, American and Japanese auto markets is less than 5%. China and other BRIC countries are above 10%, while auto semiconductors can grow by 15-20% because the electronic systems used in automobiles are more than ever. By 2019 China The automotive electronics market is comparable to Europe and North America.

In 2012, China's auto semiconductors increased by 12% year-on-year. Due to the increasing strategic pressure of semiconductor manufacturers, the global automotive semiconductor CAGR is expected to be 7% from 2012 to 2017; China's automotive semiconductor CAGR is 15%. It is worth mentioning that in 2012, China's market share is small, Japan is the largest, North America and Europe are close behind; after 5 to 7 years, China will be equal to North America and Europe. In 2019, global HEV/EV production will reach 9 million units, accounting for about 9% of global vehicle production.

In addition, by 2019, Japanese OEMs' HEV/EV production will account for about 30% of global HEV/EV production. The global share of HEV/EV produced in China will increase from 3% in 2011 to 18% in 2019. The domestic HEV/EV production of OEMs will account for 10% of global HEV/EV production by 2019. It is a pretty good size.

ON Semiconductor Automotive Business Strategy

ON Semiconductor is one of the top 10 automotive semiconductor suppliers in the world. In the automotive segment, ON Semiconductor’s revenue from the automotive segment in 2012 was $752 million (26% of the company’s revenue), up 4.5% year-on-year; the leading edge is in powertrain, body, infotainment systems. , power supply, vehicle network.

The automotive semiconductor market grew by 10% year-on-year, from automotive sales in emerging markets, which account for more than 50% of the global market, as well as fuel economy, safety, convenience and infotainment systems, and hybrid electric vehicles (HEV)/( EV) Electric vehicles are driving a five-fold increase in semiconductor components in power electronics systems.

The key growth drivers of ON Semiconductor include advanced LED lighting ICs, parking assist ICs, one-button start/stop ICs (uHybrid), switching power supply/motor driver ICs/Intelligent Power Modules (IPM), angle/pressure and position sensor interface ICs, LIN/CAN/FlexRay transceivers, MOSFET/IGBT/protection, and penetration into the Asian market.

ON Semiconductor's automotive business strategy is mainly reflected in three aspects. First, focus on growing customers and applications, selling semiconductor devices used to build automotive systems; second, taking advantage of "ASIC + ASSP + discrete = solution", the main market includes engine management systems, headlights, parking assistance Systems, and related electronic systems, such as dashboards, infotainment, door modules, driver assistance systems, etc. Third, accelerate development in Asia and China.

The challenge of realizing this process is that in the automotive environment, the temperature of the components will experience ups and downs, and the devices generally used for industrial application temperatures cannot meet the requirements of automotive applications; from the specificity of semiconductor applications, a component will be damaged. Lead to failure of the entire module and vehicle. In addition, in terms of innovation, the forward-looking nature of semiconductor manufacturers is very important, because the development of the module takes several years to enter mass production.

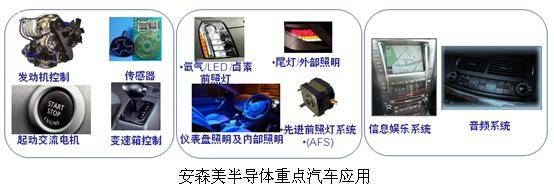

ON Semiconductor's key automotive applications and solutions

ON Semiconductor's automotive applications focus on fuel economy, including engine control, gearbox, micro hybrid vehicle (uHybrid), hybrid vehicle (HEV), infotainment system, including audio, telematics, analog and digital tuning , mechanical (or less) system; body, including lighting (LED, HID, helium, advanced headlamp system (AFS), interior lighting (dashboard, ground, accent lighting)), automotive air conditioning (HVAC), door Safety, including parking, braking, and electric power steering (EPS).

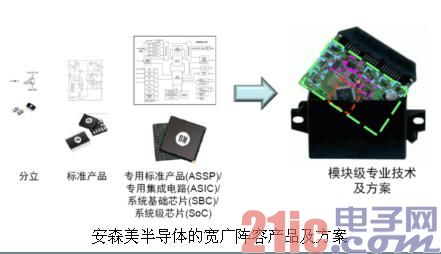

ON Semiconductor has a wide range of automotive products and package families that can be divided into four major components: standard components across all applications, including TVS/protection, rectifiers, Zener diodes, logic, constant current regulators (CCR), transistors. , MiniGate devices; memory, such as EEPROM; power devices such as ignition IGBT, MOSFET (planar, trench), SmartFET (low side, high side); analog-mixed signals, including voltage regulator (low dropout (LDO)) , standard analog, low quiescent current (Iq), driver (high-side/low-side/H-bridge, pre-FET, relay, motor driver, LED), CAN/LIN/FlexRay, system-based chip (SBC), sensor interface, Switching Power Supply (SMPS), Application Specific Standard (ASSP), Custom Application Specific Integrated Circuit (ASIC), Tracker/Comparator/Operational Amplifier.

ON Semiconductor's broad lineup products and solutions range from discrete devices to standard products to application specific standard products (ASSP) / application specific integrated circuits (ASIC) / system basis chips (SBC) / system-on-chip (SoC), and module-level professional Technology and solutions to meet the different requirements of customers.

Strong local support and services

In the next five years, China's automotive and automotive semiconductor markets will grow substantially, and China's business is more critical to ON Semiconductor. Whether it is the business brought to China by the Western market or the newly developed customer business with a growth rate of up to 20%, ON Semiconductor has long-term planning. With the Chinese auto market catching up with Europe and the United States, in addition to providing automotive solutions for ASIC + ASSP + discrete components, ON Semiconductor will continue to invest in localized R&D support (such as the Automotive Solutions Engineering Center (SEC)) to expand China FAE. The team will better serve the Chinese automotive electronics market; establish close cooperation with local first-tier customers and OEMs, and cooperate with them to quickly launch new products to help host manufacturers gain market opportunities.

Pay attention to ON Semiconductor's official WeChat to learn more innovative and energy-efficient solutions

Problems with failing factory relays, connectors/terminals and fuse contacts are also common when excessive load is placed on them.

Yacenter has experienced QC to check the products in each process, from developing samples to bulk, to make sure the best quality of goods. Timely communication with customers is so important during our cooperation.

If you can't find the exact product you need in the pictures,please don't go away.Just contact me freely or send your sample and drawing to us.We will reply you as soon as possible.

Plate Harness,Pcb Board Harness,Pcb Board Wiring Harness,Pcb Plate Harness

Dongguan YAC Electric Co,. LTD. , https://www.yacenter-cn.com